2011 Fourth Quarter

- Compensation cost increases are continuing in a solid “holding pattern”.

- Total compensation for state and local government employees rose only 1.3 percent over the previous 12 months. This is the lowest year-on-year increase for public sector compensation since the series began in June of 1982.

- With soft increases in wage and salary compensation, employers may find additional employee communications useful to ensure understanding of the full value of employer provided benefits.

12-month ECI holds flat with 3rd quarter level

According to the Employment Cost Index released Tuesday January 31st, by the U.S. Bureau of

Labor Statistics, compensation costs to civilian employers are 2 percent higher than they were a year ago1

. This increase in employer spending on wages, salaries, and benefits across the civilian U.S. labor force is flat with last quarter’s 12-month increase, consistent with compensation cost increases continuing in a solid “holding pattern” since mid-2010.

Data Source: BLS (ECI Historical Listing, January 31, 2012)

Annual inflation (CPI-U) currently stands at 3.0 percent2 .

State and local governments continue contraction in compensation increases

Employees of state and local governments continue to face deceleration in year-over-year changes in compensation, with no signal that this downward trend is abating.

The contrast between the 12-month percent change in compensation costs for the private and public sectors is not surprising considering that in the past two years, the private sector has had just two months of shrinking employment numbers (January and February of 2010). The public sector (including the federal government), on the other hand, has seen 18 months of shrinking employment (and that time period even includes the massive hiring for the federal decennial census).

Wage and salary costs vs. benefits – the private sector

For employees in the private sector, wage and salary cost increases over the past 12 months continue their unprecedented low and flat pattern. Benefits alone drove this quarter’s acceleration in the private sector 12-month employment cost increase. The percent change of employers’ spending on private sector employee benefits rebounded to 3.6 percent, but that for wages and salaries dropped slightly to 1.6 percent.

Institute for Compensation Studies™

Data Source: BLS (ECI Historical Listing, January 31, 2012)

The speed at which benefit costs rise is an important contributor to what employees cost their employers. Benefits contribute roughly 30 percent, on average, to total employment compensation3 . The increased benefit costs that capture compensation payment in the form of overtime pay and what is officially termed “non production bonus pay”, to name two, are likely to be recognized by employees as additional compensation. A dissonance may be created, however, when benefit costs rise for employers, but employees don’t see the additional dollars flowing to them. For example, even as employees are paying a greater share of their healthcare benefits, rising healthcare costs can simultaneously be driving up the dollars that employers must shell out as well. It is important for employers to keep in mind that additional communication may be needed when the cost increase of benefits is rising sharply to make sure employees fully understand their total compensation package.

Wage and salary costs vs. benefits – the public sector

With inflation at 3.0 percent, salary and wage costs for state and local governments are shrinking in real terms. For government employees (state and local), salary and wage costs rose only 1.0 percent over the 12-month period ending December 2011. Flat with last quarter, this is the lowest year-on-year increase for public sector wage costs over the ECI series (begun in June 1982). Year-on-year increases in benefit costs dropped for the third quarter in a row to 2.1 percent, continuing serious compression of annual increases.

Institute for Compensation Studies™

Data Source: BLS (ECI Historical Listing, January 31, 2012)

Lackluster job openings in the government sector suggest no upturn for the public sector labor market. Hires reported in the government sector continue to average below 300,0004 .

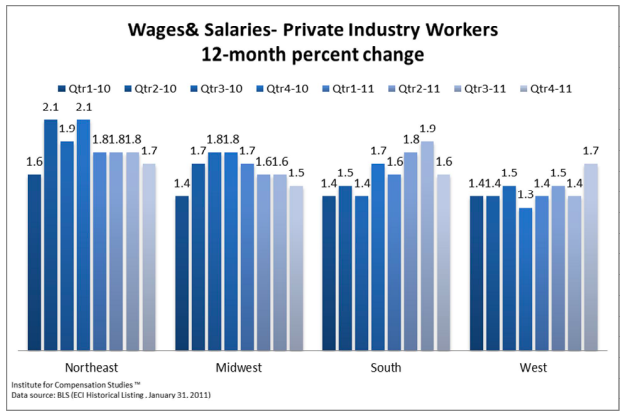

Regional Variations

While wages and salaries in the private sector have, on the whole, been following a flat growth pattern, acceleration patterns vary across U.S. regions. In the West, for example, wages and salaries rose 1.7 percent for the 12-month period ending December, 2011. This is the highest year-on-year growth the West has experienced since the second quarter of 2009. The South has also seen a similar upward, albeit stronger but more variable, growth pattern over the past eight quarters. In the Northeast and Midwest, however, year-on-year growth has either fallen or remained stagnant over the past four quarters. While these regions both experienced an upward turn in the second quarter of 2010, since then the growth trend in wages and salaries has remained soft.

If we look within these regions, we will find further geographic differences. In the Northeast, for example, while the Philadelphia area experienced growth of 2.3 percent for the 12-month period ending December 2011, the New York area only saw 1.6 percent growth in wages and salaries for the same period. In the Midwest, while the Minneapolis region saw a 2 percent rise over the past year, Chicago and Detroit grew by less than 1 percent for the 12-month period ending December 2011.

- 1Seasonally adjusted, compensation costs increased 0.4 percent for the 3-month period ending December 2011. This is a

slight acceleration from the previous quarter’s 3-month ECI of 0.3 percent for the period ending September 2011. - 2The Consumer Price Index for All Urban Consumers (all items) index has risen 3.0 percent, for the 12-month period

ending December 2011. See Consumer Price Index Summary, January 19, 2012, USDL-12-0061. http://www.bls.gov/news.release/cpi.nr0.htm. - 3In September 2011, wages and salaries accounted for 69.4 percent of total employee compensation, while benefits accounted for the remaining 30.6 percent. Data for December 2011 is scheduled to be released on Wednesday, March 14, 2012, at 10:00 a.m. (EDT). See U.S. Bureau Labor Statistics, News Release, Employer Costs for Employee Compensation news release text, USDL-11-1718, December 7, 2011, http://www.bls.gov/news.release/pdf/ecec.pdf, downloaded 1/31/12.

- 4U.S. Bureau of Labor Statistics. Job Openings and Labor Turnover Survey (JOLTS). Series No:JTS90000000JOL.