U.S. Employment Cost Index, Q1 2024 Commentary

2023 Fourth Quarter Summary

2024 First Quarter Summary – Good news for employers and employees

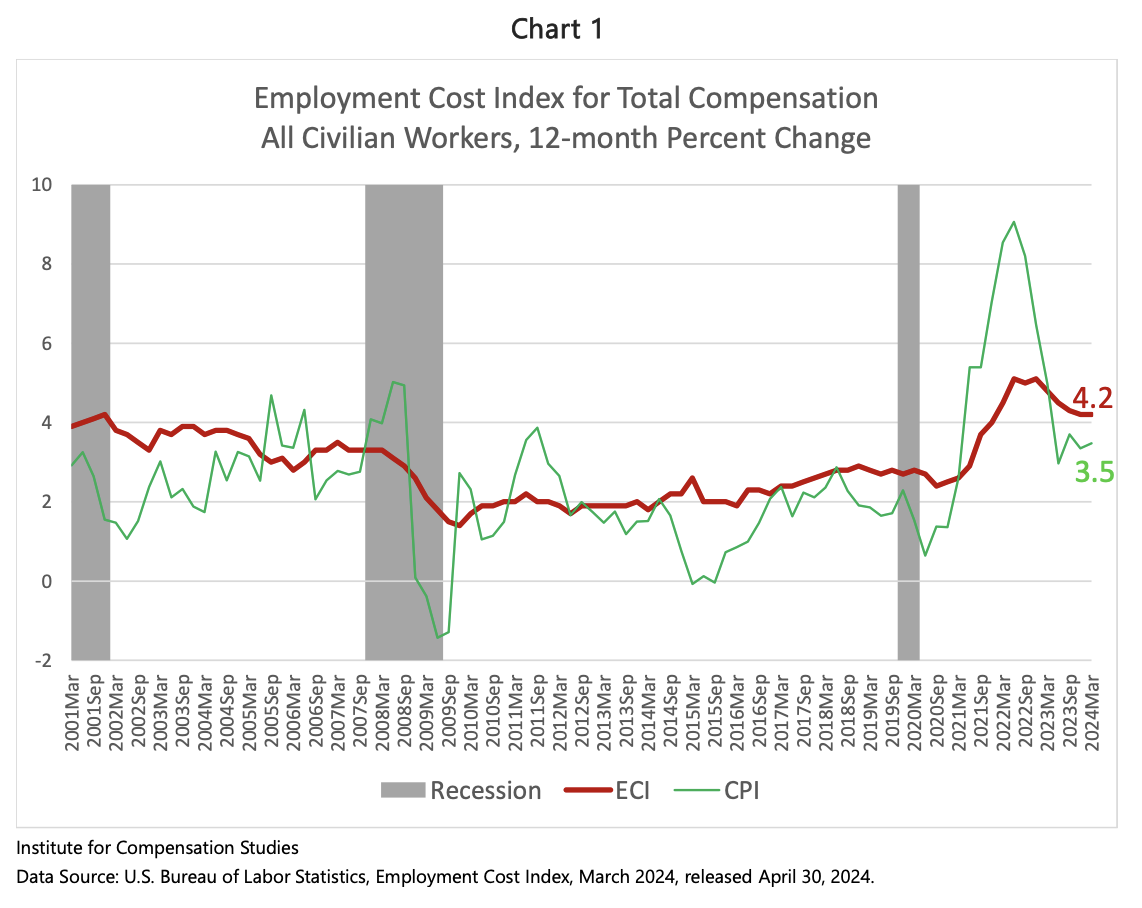

Released on April 30, 2024, the U.S. Bureau of Labor Statistics’ 12-month growth rate of compensation costs (holding composition fixed) held flat at last quarter’s level of 4.2 percent, exceeding consumer inflation for the fourth quarter in a row (Chart 1, Table 1). The Q1 2024 Employment Cost Index (ECI) is both solidly below its 2022 high of 5.1 percent and registering above the general price inflation experienced by U.S. households (CPI). This simultaneously reflects gentler increases in the costs employers pay for employee compensation and a continuing reversal of the previous eight-quarter trend of erosion in employees’ purchasing power.

Government sector wages and salaries picking up speed

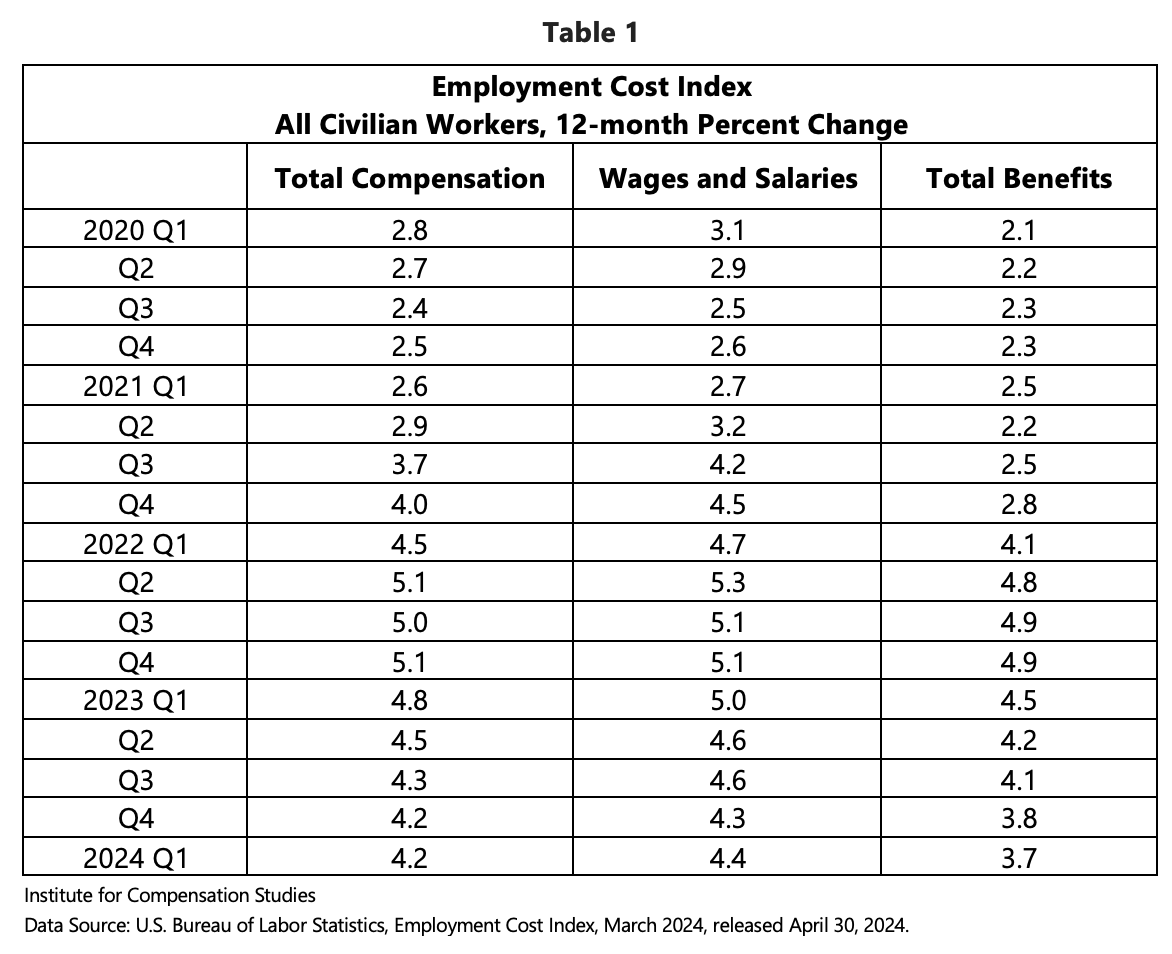

The 12-month growth rates of state and local government sector wages and salaries and total benefits have exceeded those in the private sector for four quarters in a row (Chart 2). The 12-month ECI for government sector wages and salaries spiked up to 5.0% from 4.6% last quarter. For private sector employees, the 12-month employment cost index for wages and salaries has declined steadily from its 5.7 percent peak in Q2 (June) 2022, with the ECI for private sector benefits declining even more. The peaks and troughs of compensation growth rates in the government sector typically lag those in the private sector. This quarter’s 12-month ECI for government sector wages and salaries of 5.0% continued the upward trend that began in Q3 of 2021. It remains to be seen if the year-on-year increase in wages and salaries for the government sector will reach the recent peak growth experienced in the private sector (5.7% in Q2 2022). This quarter’s steep increase in the 12-month ECI for government employees correlates with that of unionized employees.

Acceleration in compensation growth rates for union employees

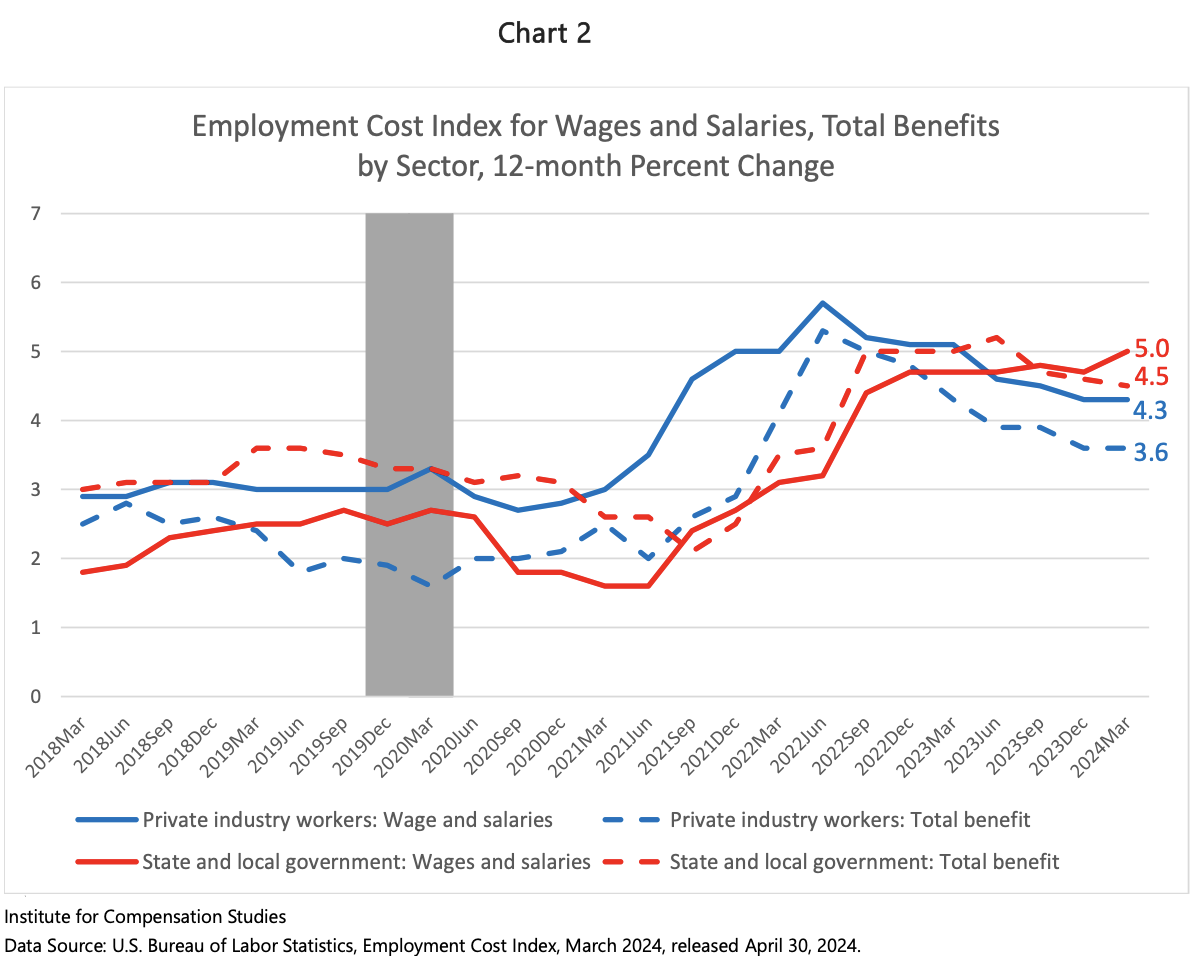

As the annual growth rate of compensation costs for non-union employees continued its downward trend, that of their union counterparts spiked further upward, climbing from 4.5 percent to 5.3 percent since the start of the year. (Chart 3). This is the second quarter in which the 12-month ECI of total compensation for union workers exceeded that for non-union workers, reflecting a catch-up for union workers.

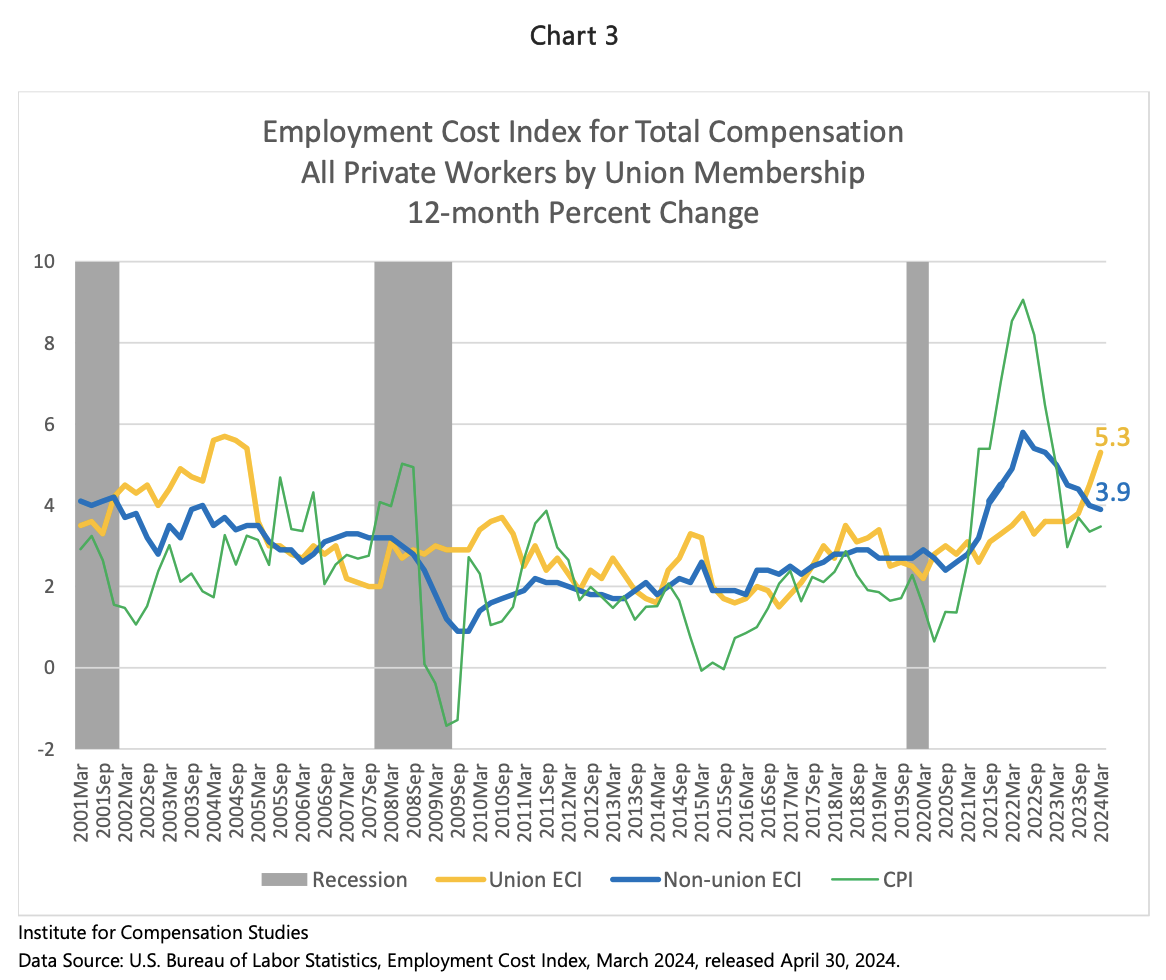

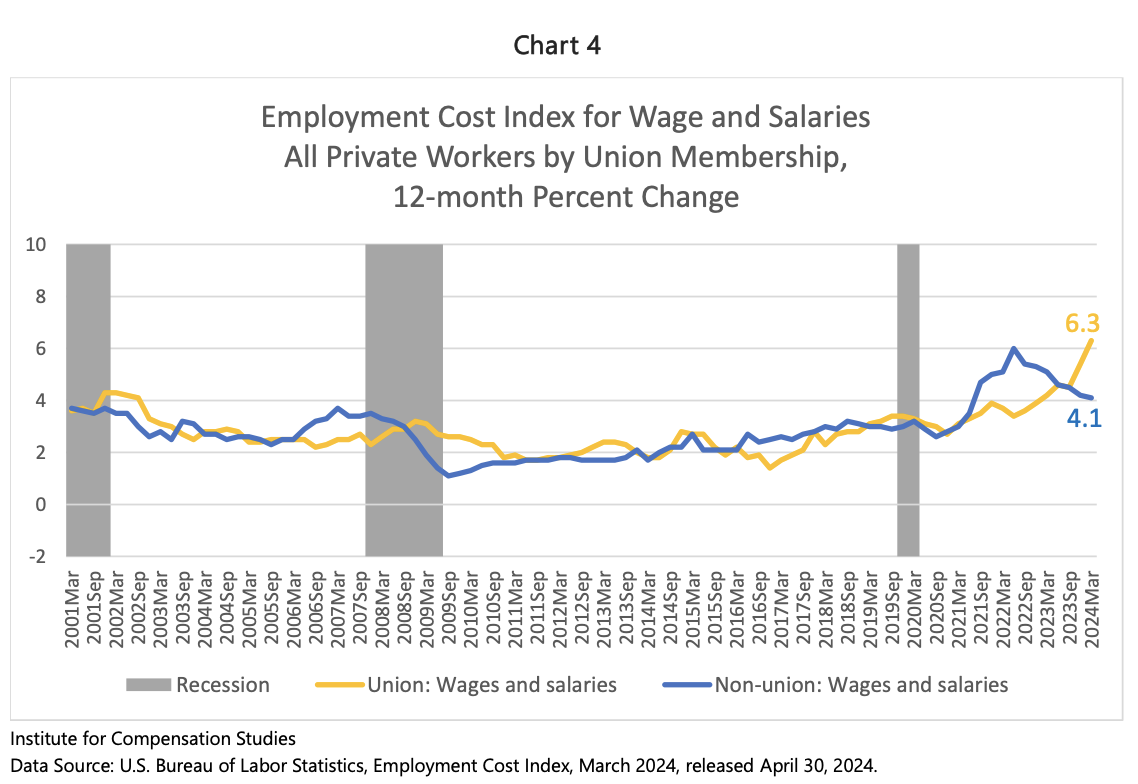

Focusing solely on wages and salaries, union workers gained even more ground. Year-on-year, wages and salaries increased 6.3 percent in the first quarter of 2024 for union employees. This is more than two full percentage points above that for their non-union counterparts and notable even in the context of the past two decades (Chart 4).

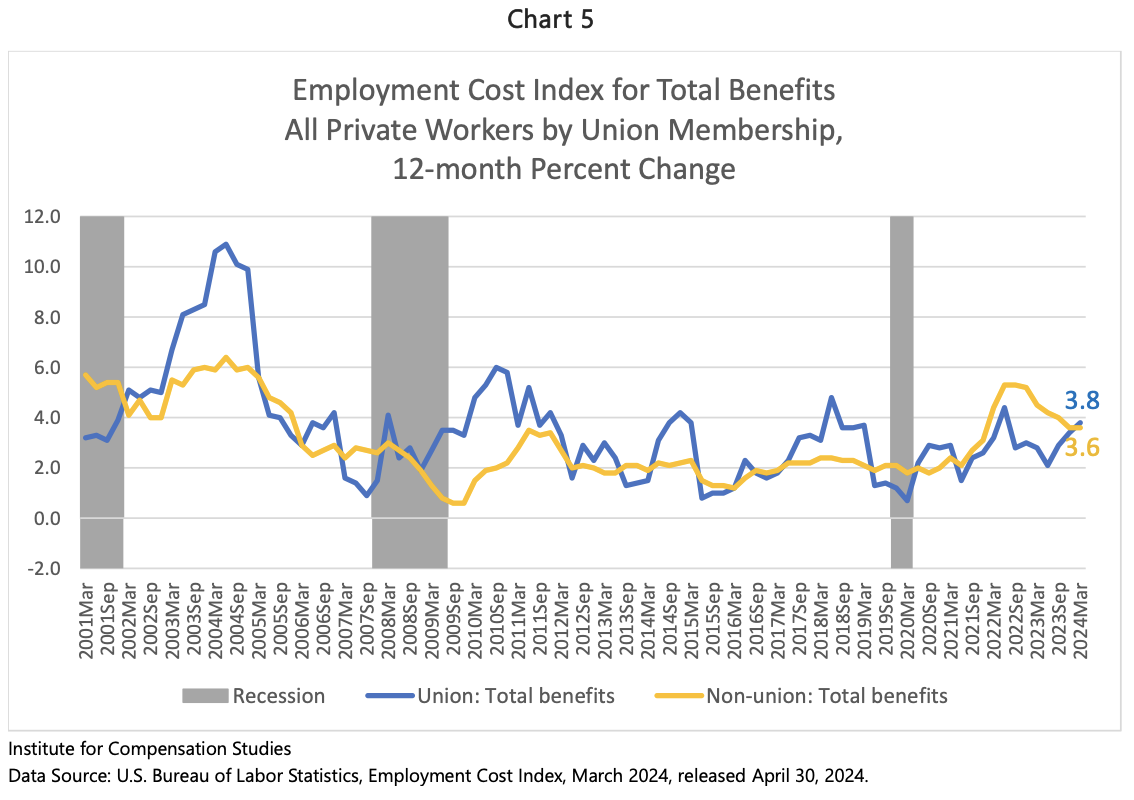

By contrast, the 12-month growth rates of the total benefits component of compensation in Q1 (March) 2024 were much closer for union and non-union employees, at 3.8 percent and 3.6 percent, respectively. The year-on-year rate of increase in employers’ cost for union-employee benefits exceeded that of non-union employees for the first time since Q1 (March) of 2021 (Chart 5).

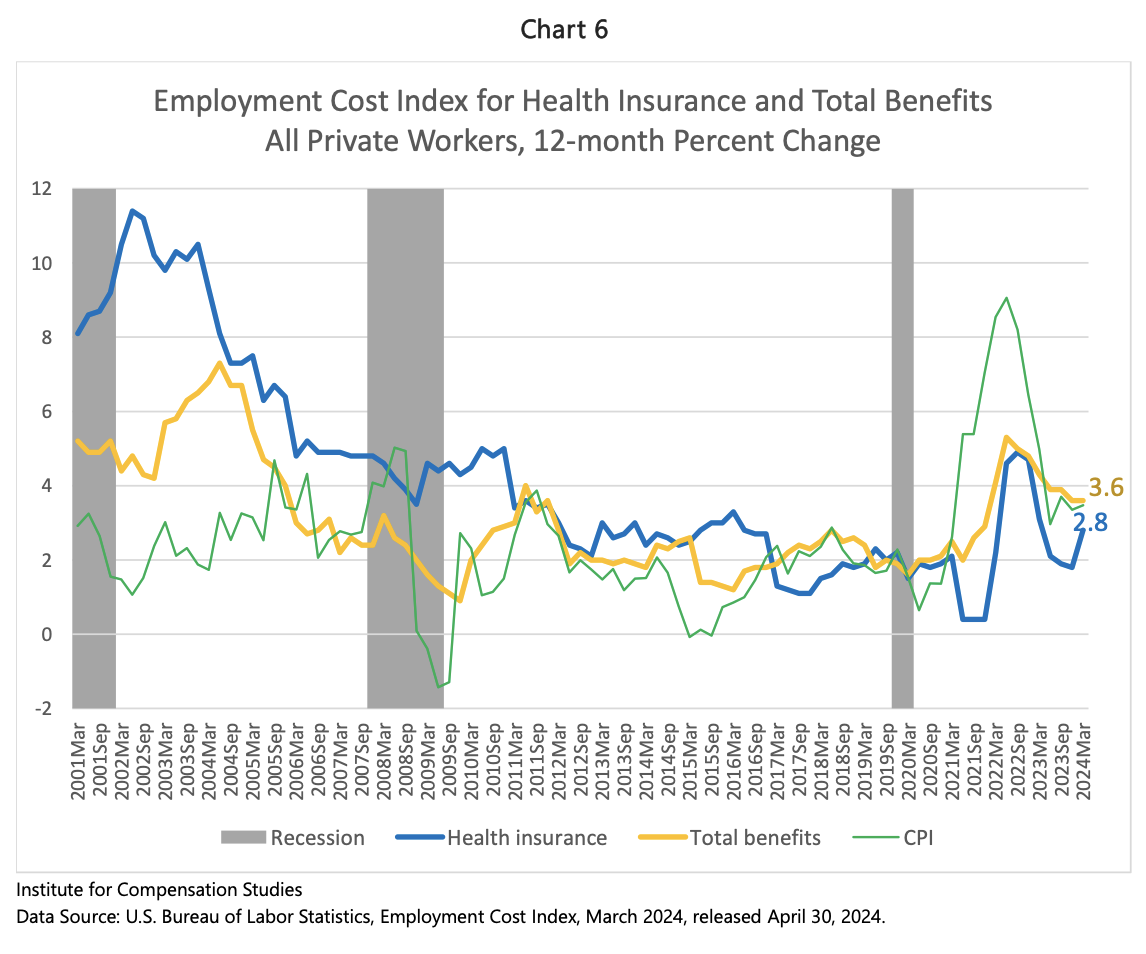

Trend in growth rate of employer costs for employee health insurance sharply reverses course

The growth rate in employer costs for employee health insurance benefits, which had been softening since Q4 (December) 2022, dramatically reversed course in the first quarter of this year. Employer costs for employee health insurance benefits rose 2.8 percent year-on-year, a sharp increase from last quarter’s 1.8 percent (Chart 6). However, this 12-month growth rate remains under 3 percent, which is in line with the decade-long average between the 2008 and COVID recessions.

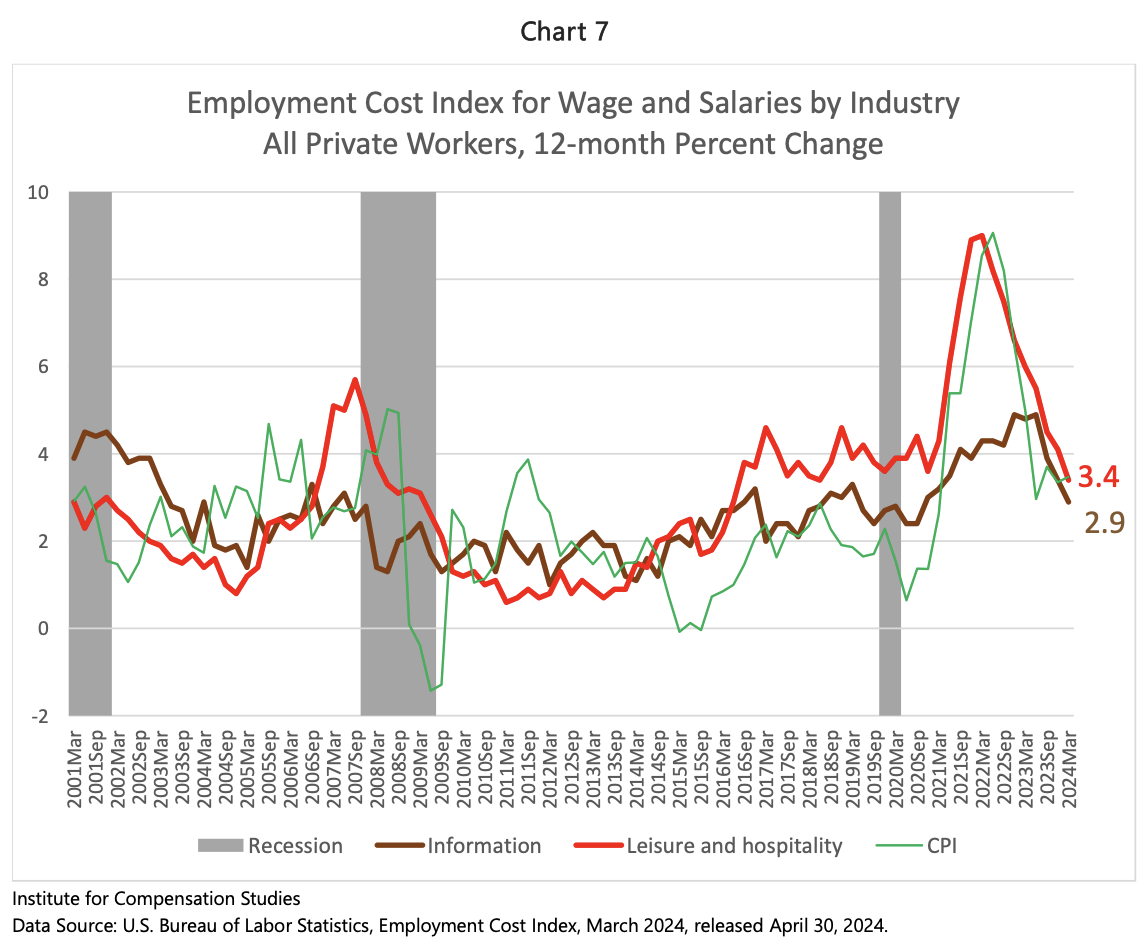

Wages and salaries in Information and Leisure and Hospitality sectors grow slower than inflation

While the 12-month growth rate of compensation costs employer costs for employee compensation economy-wide exceeded consumer inflation in Q1 2024, this was not the case for two sectors – Information and Leisure and Hospitality. For this quarter, the 12-month wage and salary ECI was 3.4 percent for the Leisure and Hospitality sector and 2.9 percent for the Information sector (see Chart 7).

The Employment Cost Index (ECI) is produced by the U.S. Bureau of Labor Statistics to measure trends in the costs of compensation paid by employers to their employees, controlling for composition of the workforce. The ECI is one of the labor market indicators used by the Federal Reserve Board to monitor the effects of fiscal and monetary policies and is released quarterly with a one-month lag.

Data for the Q1 2024 reference period were collected from a probability sample of approximately 23,600 occupational observations selected from a sample of about 5,600 private industry establishments and approximately 7,500 occupational observations selected from a sample of about 1,400 state and local government establishments that provided data at the initial interview.

Link to most recent ECI release: https://www.bls.gov/news.release/eci.toc.htm.

The Institute for Compensation Studies (ICS) at Cornell University’s ILR School is an interdisciplinary center that researches, teaches and communicates about monetary and non-monetary rewards from work, and how these rewards influence outcomes for individuals, companies, industries, and economies. At thecrossroads between scholarship and practice, ICS is an exchange dedicated to helping new knowledge hit its mark in the world of work.

Contact:

Erica Groshen

Senior Economic Advisor

Institute for Compensation Studies

Authors:

Seung-Hun Chung

Erica Groshen

Linda Barrington

The Institute for Compensation Studies