Tracking Inflation Reduction Act Manufacturing Investments

The Inflation Reduction Act of 2022 (IRA) is a critical catalyst to accelerate the sustainable development of the clean energy industry within the United States. The primary purpose of this research is to track the impact of the IRA on regional economic development and job creation in the clean energy fields across the country, with more in-depth research, specifically in New York.

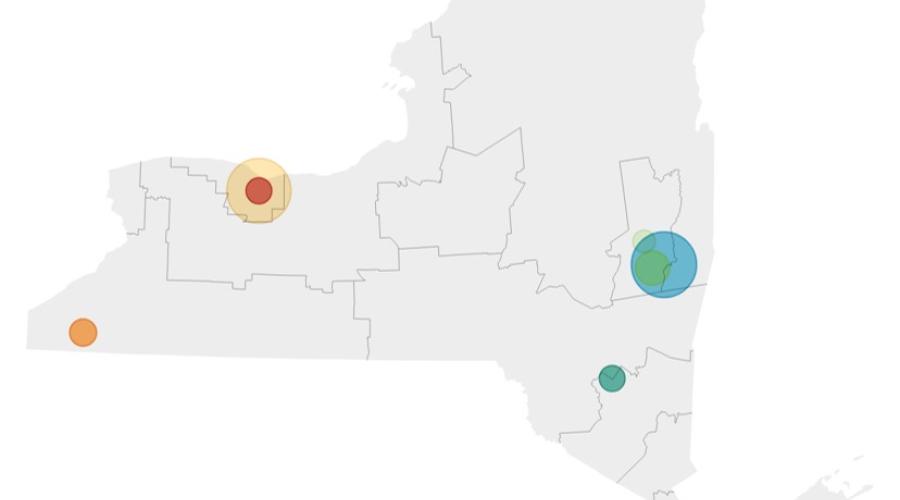

The Climate Jobs Institute has collected data on relevant projects that are potentially eligible for IRA tax credits or investments triggered by the passing of the IRA within the clean energy manufacturing industry, given the consideration of IRA tax credit eligibility for locally manufactured products. All projects are classified under one of three sectors: electric vehicles (EV), renewable energy, and other energy technologies, and then further divided into 15 subsectors.

This research holds practical implications for union organizers, providing insights into the location of new manufacturing facilities, the scale of investments, and the anticipated job creation in these facilities. Additionally, our research documents the current involvement of unions in each listed project. For legislators, this data offers a comprehensive understanding of the local impact of the IRA on their state and district's economy. Recently, Climate Jobs Institute Executive Director Lara Skinner presented this data to the House Sustainable Energy and Environment Coalition Congressional Clean Jobs Task Force.